Mutual Fund

The Mutual Fund industry in India started in 1963 with the launch of the

Unit Trust of

India (UTI). The UTI was a joint initiative between the Government of India and the

Reserve Bank of India (RBI). Initially it was regulated by RBI and administered by UTI.

The fund was created to encourage small investors to participate in the stock market. At

the end of 1988, UTI had 6,700 crores of Assets Under Management (AUM). The Securities

and Exchange Board of India (SEBI) was established in 1992 to regulate and supervise

mutual funds. SEBI issues regulations and circulars to protect the interests of

investors. The mutual fund industry has grown significantly over the years, with the

Assets Under Management (AUM) increasing from Rs. 9.75 trillion in 2014 to Rs. 61.16

trillion in 2024. This is a more than six-fold increase in just 10 years.

Welcome to stress-free Mutual Fund Investments with Us

Experience mutual funds like never before whether you are an investor

looking to

create wealth or a trader waiting for smart opportunities.

- Stress-Free: One-stop shop for all your investment needs.

- You are Priority: Personalised service support.

- Research-Backed: Stocklal shares with Sharekhan Q Square Mutual Fund

Research philosophy.

- Informed by Tech: Innovative mutual fund tools and solutions.

- Local & Global: Stocklal Shares with Sharekhan’s Indian market expertise

& the global standards and experience of BNP Paribas.

Mutual fund offerings

You can easily pick the one that suits your needs

SIP

A quick way to invest in mutual funds! With SIP, start multiple SIPs

curated as per your requirements at one go.

Lumpsum Go

Looking to invest your surplus money? Lumpsum Go lets you place

goal-based orders in MFs without the hassle of picking and choosing!

Disclaimer: Mutual Investments are subject to market risks,

read all the related documents carefully before investing.

Advantages of investing through mutual funds

Your money, professionally managed

A full-time Fund Manager keeps a wary eye on your investments.

The end goal is to maximise profits and reduce the effect of market headwinds.

Diversification to mitigate market risks

MFs allow you to diversify your investments across several

securities and asset classes, like Equity, Debt, Gold and more.

Affordability (low-cost investments)

As a mutual fund pools money across many investors, the cost is

spread over a larger portfolio with the applicable benefits of scale.

Liquidity

Most open-ended mutual funds offer liquidity through the

redemption process.

Tax benefits

Under Section 80C of the Income Tax Act, 1961, investments in

Equity-Linked Savings Scheme (ELSS), which are a type of mutual funds, up to INR

1,50,000 qualifies for tax benefits.

Well-regulated and transparent

Mutual funds are regulated by SEBI. As an investor, you have

access to NAVs and returns and portfolio information as the AMC is mandated to share

them with you.

Disclaimer: Mutual Investments are subject to market risks,

read all the related documents carefully before investing.

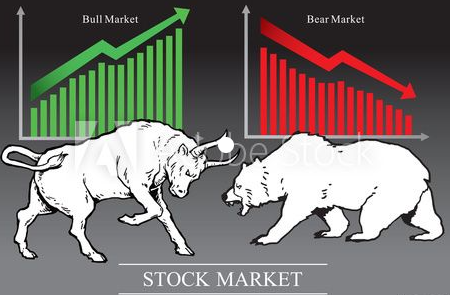

Equity Investment and Trading

Equity Trading in India

“Equities” refer to the shares or stocks that a public company offers to the

investor in

exchange for capital. These equities can be bought or sold in the share market.

Equities have emerged as a viable market to grow one’s wealth over the past

few decades

in India. Using the power of compounding (often dubbed as the Eighth Wonder of the

World), investing in stocks and the share market has proven beneficial to many

investors. Our country enjoys a thriving equity trading space.

Having said that, it requires knowledge and experience to multiply money

over any period

of time. To accomplish this goal, the majority of investors choose trading on the stock

market. Equity trading entails purchasing and reselling company shares on the stock

market. With an equity trading account, you can do this.

For trading on the financial markets in India, registration with a brokerage

company is

required. In addition to unparalleled brokering services and sleek, efficient platforms,

Stocklal Shares along with Sharekhan also provides actionable Research to its customers.

Making the appropriate decisions on which stocks to buy and sell is made easier.

Trading in equity market

Besides being a good avenue to build your corpus, the equity market is

also popular due to:

- Simple to enter and exit equities

- Diverse universe of listed companies

- Taxation is friendly

- Well-regulated and transparent

Each share of stock denotes ownership in a publicly listed company.

Investors find this appealing because when a company succeeds, the value of their

stocks increases, rewarding the investors. A corporation runs the risk of seeing its

stock value decline when business is sluggish. Stocks are easily and quickly

purchased and sold, and the activity surrounding a particular stock affects its

value. For instance, the price of the stock typically increases when there is a

large demand to invest in the company, and it typically declines when there is a

significant desire to sell stocks.

Disclaimer:Investments in stock market are subject to market

risks, the degree of which depends on the nature of each investment, and may not be

suitable for all investors.

Stocklal Equity Portfolio Handling Services

Stocklal Portfolio Objectives:

- Our Stocklal Equity Portfolio is a basically designed with a combination of

quality large cap and midcap stocks that have fundamentally strong business

growth and a consistent well performing over the years.

- Our Portfolio has well defined stock selection process, well diversified and

balanced allocation of fund that built with stocks from different industries and

various sectors to reduce risk.

- 100% assets are allocated in equity stocks and any excess cash balance is

invested in bees

- All stock orders are placed through Sharekhan admin terminal with your knowledge

and final confirmations only.

Risk factors:

Market Risk:

- As the portfolio created is invested in the equity market, if for some reasons

the equity market corrects, there will be associated risk with this product too.

Risks Associated with Full Deployment of Cash:

- In the event of market correction, there can be risk to the portfolio due to

full deployment of cash

Minimum Capital Required:

- 50 k is a minimum fund needed to handle your equity portfolio.

Disclaimer:Investments in stock market are subject to market

risks, the degree of which depends on the nature of each investment, and may not be

suitable for all investors.

Options Trading

What is Options trading?

Options are a type of Derivative instrument that is traded in the market.

Derivatives, which have no inherent value of their own, derive their value from

changes in the price of other financial instruments, known as the underlying asset.

There are mainly 4 types of underlying assets: stocks, indices, currency pairs, and

commodities. A derivative's price follows the price of the underlying security from

which it derives its value.

On the other hand, Options are contracts that grant the buyer a right rather than an

obligation to carry out their end of the bargain.

There are two types of Options trading in India: Call Options and Put Options.

Call Options: With a Call Option, you have the ability to use your purchasing

power (at the strike price) before the Options contract expires.

Put Options: A Put Option gives you the option to sell at the strike price

before the Option expires.

Good-to-knows about Options trading

- Options trading can help you make significantly higher profits if the price of

the security increases. However, note that it is more complicated than stock

trading.

- When doing Options trading, you can buy a contract at a fraction of the market

price of the underlying securities.

- Hedging is the process of using Options trading to limit losses if the price of

the underlying security declines.

- The terms "Call" and "Put" refer to the purchase and sale of respective

securities.

- Traders who trade in the Options market primarily want to take advantage of

price fluctuations. Alternatively, they aim to mitigate the risks associated

with Commodity price fluctuations.

- When buying an Options contract, an investor makes a small up-front payment

instead of the complete sum. The trader has now locked in the price of the

underlying asset or commodity till the contract’s expiration date.

- Being a derivative asset, the contract's price shifts from time to time as the

underlying asset’s price varies, which affects the trader's profit or loss.

- In India, the BSE and NSE stock exchanges mediate in the F&O segment and keep an

eye on each contract.

Disclaimer:Derivatives are complex instruments with a higher

risk than traditional investments. Before trading, you should understand how

derivatives work and whether you can afford the risk of losing your money.